10 Basic Accounting Principles & Key Assumptions 2019 GAAP Guide

Companies also have to set up their computerized accounting systems when they set up bookkeeping for their businesses. Most companies use computer software to keep track of their accounting journal with their bookkeeping entries. Larger businesses adopt more sophisticated software to keep track of their accounting journals. Bookkeeping is the process of keeping track of every financial transaction made by a business—from the opening of the firm to the closing of the firm. Depending on the type of accounting system used by the business, each financial transaction is recorded based on supporting documentation.

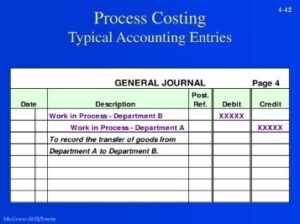

The principle of materiality recognizes that not all financial information is equally significant. Materiality dictates that financial statements should include all information that could influence the economic decisions of users. Revenue is all the income a business receives in selling its products or services. Costs, also known as the cost of goods sold, are all the money a business spends to buy or manufacture the goods or services it sells to its customers. If your company is larger and more complex, you need to set up a double-entry bookkeeping system. At least one debit is made to one account, and at least one credit is made to another account.

These the difference between product costs and period costs principles help companies present a true and fair representation of financial statements. Following GAAP guidelines and being GAAP compliant is an essential responsibility of any publicly traded U.S. company. Bookkeeping forms the foundation for generating financial statements, such as balance sheets and income statements.

This process ensures that a company’s financial records are comprehensive, accurate, and easily accessible for analysis and reporting. The foundation of bookkeeping is built upon several fundamental principles that guide the recording and reporting of financial transactions. Understanding these principles is crucial for maintaining accurate and reliable financial records. Bookkeeping involves summarizing financial data periodically, typically through the creation of financial statements.

Financial Accounting Standards Board

When all businesses follow the same principles, it becomes easier to compare financial statements and assess financial health. Accruals and deferrals are accounting adjustments made to recognize revenues and expenses in the appropriate stale dated checks accounting period. They ensure that financial statements reflect transactions when they are incurred or earned, rather than when cash is exchanged. Bookkeeping is the systematic process of recording, organizing, and maintaining financial transactions of a business or organization. It involves documenting every financial transaction, whether it’s income, expenses, assets, or liabilities. While non-publicly traded companies aren’t required to follow GAAP, it is still highly regarded by lenders and creditors.

Importance of Accuracy and Compliance in Bookkeeping

Along with several other principles, this serves to maintain an ethical standard and responsibility accounting in all financial dealings. When compiling reports, accountants must assume a business will continue to operate. GAAP must always be followed by accountants and businesses when handling financial information. At no point can a company or financial team choose to ignore or modify any of the regulations.

Bookkeeping Basics 101: 9 Bookkeeping Basics for Beginners

Five of these principles are the principle of regularity, the principle of consistency, the principle of sincerity, the principle of continuity and the principle of periodicity. Each principle is meant to guarantee and support clear, concise and comparable financial reporting. Outside the U.S., the most commonly used accounting regulations are known as the International Financial Reporting Standards (IFRS). The IFRS is used in over 100 countries, including countries in the European Union, Japan, Australia and Canada. The IFRS Foundation is responsible for overseeing, maintaining and updating the accounting standards in each of these countries.

- Foreign-based companies registered with the SEC use IFRS reporting guidelines in their U.S. disclosure filings.

- GAAP must always be followed by accountants and businesses when handling financial information.

- It is usually prepared at the end of an accounting period, such as a month or year.

- The year-end reports prepared by the accountant have to adhere to the standards established by the Financial Accounting Standards Board (FASB).

Periodicity Assumption

The liability accounts on a balance sheet include both current and long-term liabilities. Accounts payable are usually what the business owes to its suppliers, credit cards, and bank loans. Accruals will consist of taxes owed including sales tax owed and federal, state, social security, and Medicare tax on the employees which are generally paid quarterly.

One of the first decisions you have to make when setting up your bookkeeping system is whether or not to use a cash or accrual accounting system. If you are operating a small, one-person business from home or even a larger consulting practice from a one-person office, you might want to stick with cash accounting. Domestic U.S. companies whose securities trade on public exchanges must use GAAP guidelines, as do businesses operating in regulated industries. Notably, IFRS standards do apply to some business entities operating in the United States. Foreign-based companies registered with the SEC use IFRS reporting guidelines in their U.S. disclosure filings. Some U.S. small and mid-size enterprises (SMEs) voluntarily use IFRS accounting procedures, which are neither expressly permitted nor prohibited under applicable U.S. laws.

Bookkeepers have to understand the firm’s chart of accounts and how to use debits and credits to balance the books. Publicly traded domestic companies are required to follow GAAP guidelines, but private companies can choose which financial standard to follow. Some companies in the U.S.—particularly those that are traded internationally or see a lot of international business—may use dual reporting (i.e., both methods) when preparing financial statements.

Bir yanıt yazın